Garanti BBVA in Numbers

| Branch |

798 |

795 |

| Domestic |

790 |

787 |

| Abroad |

8 |

8 |

| Personnel |

23,418 |

23,311 |

| ATM |

6,181 |

6,558 |

| POS |

874,417 |

870,653 |

| Total Customer |

29,470,947 |

30,141,660 |

| Digital Banking Customer |

17,630,908 |

18,040,749 |

| Mobile Banking Customer |

17,476,210 |

17,893,337 |

| Credit Card Customer |

12,903,502 |

13,226,733 |

| Credit Cards |

18,598,463 |

19,153,633 |

| Debit Cards |

22,912,747 |

23,387,621 |

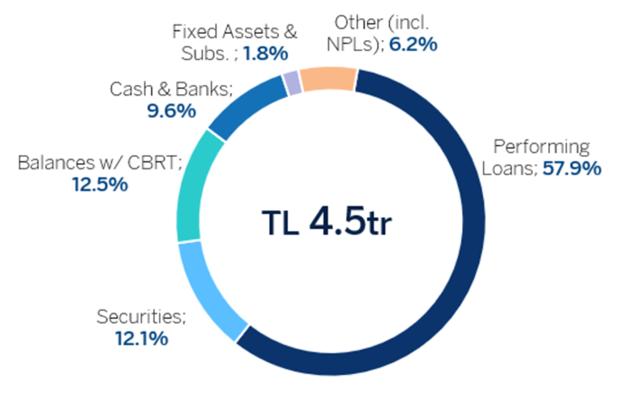

ASSET BREAKDOWN

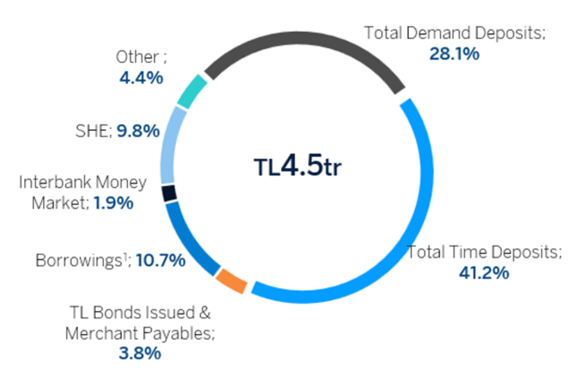

LIABILITIES & SHE BREAKDOWN

1Includes funds borrowed, sub-debt & FC securities issued.

Note: Figures are per 31 December 2025 BRSA consolidated financials.

MARKET SHARES

| Consumer Loans inc. Consumer CCs |

17.3% |

17.7% |

39 bps |

#1 |

| Cons. Mortgage Loans |

15.3% |

16.0% |

76 bps |

#2 |

| Consumer Auto Loans |

31.0% |

31.9% |

91 bps |

#1 |

| Cons. General Purpose Loans |

15.9% |

16.5% |

66 bps |

#2 |

| TL Business Banking |

8.4% |

8.0% |

-38 bps |

#2 |

| # of CC customers1 |

14.5% |

14.7% |

15 bps |

#1 |

| Issuing Volume (Cumulative)1 |

17.3% |

17.3% |

4 bps |

#1 |

| Acquiring Volume (Cumulative)1 |

15.8% |

15.8% |

-3 bps |

#2 |

Rankings are among private banks as of December 2025

1 Sector figures used in market share calculations are based on bank-only BRSA weekly data as of 26.12.2025, for commercial banks

2 Cumulative figures and rankings as of December 2025, as per Interbank Card Center data. Rankings are among private banks.

| Net Interest Income |

204,745 |

| Operating Expenses |

-178,553 |

| - HR Costs |

-61,259 |

| - Other Operating Expenses |

-117,294 |

| Net Exp. Loan Loss Prov. (excl. Currency impact)1 |

-34,939 |

| Net Fees & Commissions |

145,477 |

| NET INCOME |

111,262 |

| Return on Average Equity |

29.1% |

| Return on Average Assets |

2.9% |

| Non-Performing Loans Ratio |

3.1% |

| Capital Adequacy Ratio |

17.5% |

| Net Cost of Risk1 |

1.51% |

| FEE / OPEX |

81% |

Note: Figures are per 31 December 2025 BRSA Consolidated financials

1 Neutral impact at bottom line, as provisions due to currency depreciation are 100% hedged (FX gain included in Net trading income line)