Double Materiality Analysis

Double Materiality Analysis

To determine material issues, the European Financial Reporting Advisory Group’s (EFRAG) European Sustainability Reporting Standards (ESRS), the International Sustainability Standards Board (ISSB), which is part of the International Financial Reporting Standards (IFRS), as well as IFRS S1 (General Requirements for Disclosure of Sustainability-Related Financial Information), IFRS S2 (Climate-Related Disclosures), and the GRI Standards have been taken as references. Similar to previous years, the "double materiality" approach has been adopted in identifying material issues.

This involves assessing the impacts of our activities on the environment and people — impact materiality — as well as the effects of environmental and social issues on the company's operations — financial materiality. Impact materiality addresses the positive or negative effects that the Group's activities create on its surroundings. Financial materiality, on the other hand, focuses on the risks and opportunities stemming from how the environment influences or may influence the Group's economic status.

Unlike in previous periods, analyses have been conducted on the impacts, risks, and opportunities defined under the specific categories of ESRS. Topics deemed significant for the Bank have been identified and disclosed accordingly. The significance of these topics has been evaluated in light of the Group’s strategic priorities, market conditions, stakeholder interactions, and regulatory developments. These are subject to periodic review as developments in these areas arise.

While impact and financial materiality were considered in the materiality analysis, disclosures prioritize financial materiality to align with Türkiye Sustainability Reporting Standards.

Methodology

Garanti BBVA's double materiality analysis is based on prior studies and the most accurate and up-to-date information available. This analysis integrates tools, standards, and processes covering both internal mechanisms and market references. Such an approach ensures that the analysis evolves in alignment with the Group's strategy, stakeholder expectations, and regulatory requirements. The methodology is structured into three phases: contextual analysis, identification of impacts, risks, and opportunities (IROs), and evaluation of these elements.

Active participation of teams responsible for managing each topic (Sustainability, Sustainable Office, Sustainable Finance) has been ensured during the process. Their insights and assessments regarding the likelihood and severity of key issues were considered.

Phase 1: Listing of Topics

Topics impacting or potentially impacting the Bank were identified in light of strategic priorities, stakeholder expectations, global trends, and themes outlined in advanced reporting standards such as GRI and ESRS references.

In this context, along with regulations and global reporting standards, the following methods were used for the universe of topics.

- ENCORE Tool: Developed by NCFA and UNEP-WCMC to analyze impacts on natural capital (e.g., climate, environment).

- Stakeholder Survey: Conducted to assess the prioritization and impact of sustainability topics among stakeholders, including employees, subsidiaries, customers, NGOs, and investors.

- Portfolio Impact Analysis Tool for Banks: Developed under the United Nations Environment Programme Finance Initiative (UNEP FI).

- Garanti BBVA Reputation Risk Analysis.

Phase 2: Identification and Definition of IROs

For the identified topics, assessments and definitions of impacts, risks, and opportunities were carried out with the active input of the responsible teams. Additionally:

- The UNEP-FI Impact Tool and ENCORE Tool were used to determine sectoral and geographical impacts based on the Bank’s credit portfolio.

- Stakeholder surveys evaluated the prioritization and impact of sustainability topics. Responses from various stakeholder groups such as employees, subsidiaries, customers, NGOs and investors were taken into consideration.

- Human Rights Due Diligence facilitated the identification of human rights impacts.

- Internal methodologies like Climate Change Risk Assessment and the Reputation and Non-Financial Risk Matrix provided a comprehensive risk perspective.

- Sectoral standards like those defined by SASB and the European Banking Authority (EBA) were used to identify and manage risks and opportunities specific to the financial sector.

- IROs were then categorized based on the following criteria:

- Existing/Potential: Distinguishing current impacts, risks, and opportunities from those that may arise in the future.

- Time Horizon

- Short-term: Up to 1 year.

- Medium-term: 1-4 years

- Long-term: Beyond 4 years

- Value Chain Stage: Classified as Upstream, Own Operations, and Downstream.

- ESRS Topics: Allocated to specific themes and categories per ESRS priority topic standards.

Phase 3: Evaluation

Each topic was scored using the tools mentioned above and through consultations with relevant units. Final results were reviewed and approved by the Sustainability Committee.

Impact Materiality Assessment

The "inside-out" assessment of impact materiality evaluates how an organization’s activities affect its surroundings, including people, the environment, and society at large. The applied methodology is built around three key factors determining the severity of impacts:

- Magnitude: Ranges from minimal effects to critical outcomes, ensuring that the most impactful issues are prioritized in strategic decision-making.

- Scope: Defines the extent of impact by geographical or sectoral reach (local, national, or global), allowing the Group to adjust its strategies according to the scale of risks or opportunities.

- Irremediability: Applied exclusively to negative impacts, assessing the reversibility of harm caused (e.g., biodiversity loss or severe labor rights violations).

Potential impacts were evaluated based on likelihood (ranging from less than 15% - low probability, to over 90% - near certainty) and time horizons. Protecting and respecting human rights remain top priorities for adverse impacts.

These factors were quantified by weighting severity, likelihood, and time horizon, with irremediability added for negative impacts. Impacts were classified under the following thresholds:

- Positive Impacts: High-magnitude impacts deemed likely or very likely are considered significant.

- Negative Impacts: Medium- or high-magnitude impacts with probable or current likelihood are included within the materiality threshold.

Financial Materiality Assessment

Garanti BBVA’s financial materiality assessment focuses on evaluating ESG (Environmental, Social, and Governance) risks and opportunities that have a significant impact on the Group’s financial position. This analysis aligns with international reference standards and adopts an “outside-in” approach, considering key factors such as growth, operational performance, and access to capital.

The methodology employed assesses the probability and magnitude of financial impacts based on internal and external tools and information sources. One of the key tools used in this assessment is ENCORE (Exploring Natural Capital Opportunities, Risks, and Exposure), which facilitates the identification and management of risks and opportunities related to natural capital. This tool provides insights into the dependency of economic activities on ecosystem services and their potential impacts.

Garanti BBVA’s Climate Risk Assessment process plays a critical role in evaluating physical and transition risks, analyzing the impact of ESG risks on the Bank’s operations and business model. For further details, please refer to the ‘Sustainability’ section.

Additionally, Garanti BBVA has leveraged sectoral standards such as SASB, which provides key metrics for assessing social and governance risks, particularly in areas related to human capital and business ethics.

The elements derived from sustainability and climate-related risks and opportunities identified through the double materiality analysis require comprehensive and long-term studies to assess their potential impact on cash flows and revenue growth.

However, when evaluating the credit portfolio and expected credit loss provisions associated with climate-related aspects such as the transition to a low-carbon economy, sustainable finance, and greenhouse gas emissions, no significant short-term adjustment risk to the financial statements has been identified.

The material risks identified through this analysis (excluding climate risk) have been mapped to the operational risk categories used in the Bank’s operational risk management framework. As a result, the number of identified risks, their inherent and residual risk values, and the associated risk control measures have been recorded in the Risk and Control Self-Assessment (RCSA) framework. Based on this analysis, it has been concluded that no significant short-term adjustment risk exists for accounting records.

The concrete financial impacts of studies on sustainability and climate-related risks and opportunities are expected to be observed mainly in loans, expected loss provisions and equity items in the bank's balance sheet, and these effects are disclosed only if they are of financial significance within the framework of compliance with Turkey Sustainability Reporting Standards. The financial materiality criterion was determined by taking into account a certain proportion of pre-tax profit and the analysis was carried out accordingly.

Results and Materiality Evaluation

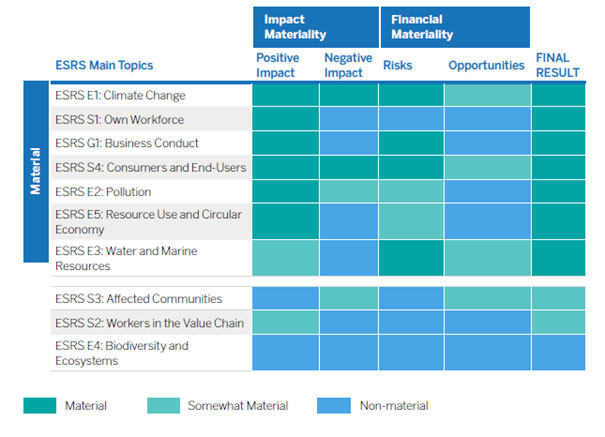

The double materiality analysis identified significant IROs under seven main themes. These findings reflect emerging challenges and opportunities shaping the organization’s business model, aligning with strategic priorities in an ever-evolving environment.

The table below outlines the results of the double materiality analysis by impact, risk, and opportunity:

RELATED HEADINGS

- Impacts, Risks and Opportunities on the Value Chain

- Impacts, Risks and Opportunities Identified as Priority Regarding Sustainability

- Integration of Double Materiality Analysis into Strategy

You can find all headings and details here.

Note: Taken from the Double Prioritization Analysis 2024 Integrated Report.