Shareholding Structure

|

Banco Bilbao Vizcaya Argentaria, S.A. (BBVA)

|

361,089,589,019 |

3,610,895,890.19 |

85.97 |

|

Others

|

58,910,410,981 |

589,104,109.81 |

14.03 |

| GRAND TOTAL |

420,000,000,000 |

4,200,000,000.00 |

100.00 |

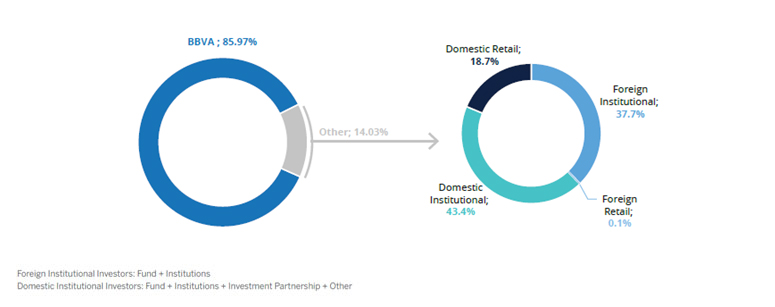

Garanti BBVA carried out its IPO in 1990 on Borsa İstanbul and became the first Turkish company to offer its shares on international markets in 1993. Garanti BBVA’s depositary receipts are listed on the OTC (Over-The-Counter) Markets in the USA. In 2012, Garanti BBVA qualified to get in the prestigious tier of the U.S. OTC market, OTCQX International Premier, where companies traded must meet high financial standards and an effective disclosure process.

Garanti BBVA has a market capitalization of TL 522 billion (USD 14.8 billion) as of year-end 2024. GARAN is the most valuable company in Türkiye. Its floating MCAP is the 12th highest with 2.7% weight in BIST100.

The Bank’s free float market capitalization corresponded to TL 73 billion (USD 2.1 billion). 38% of Garanti BBVA’s shares in the free float are owned by foreign institutional investors. Including the share of the domestic institutions, 82% of the publicly traded shares are held by institutional investors, whereas the remaining 18% are held by individual investors*.

*According to MKK (CSD of Türkiye) data on 31 December 2024.

ABOUT BBVA (Banco Bilbao Vizcaya Argentaria, S.A.)

Banco Bilbao Vizcaya Argentaria S.A. (“BBVA”), which has been our shareholder since 2011 made a voluntary takeover offer for the shares not currently held at the end of 2021. The voluntary takeover bid was finalized on May 18, 2022 and BBVA's shareholding in Garanti BBVA reached 85.97%.

BBVA is operating for more than 165 years, providing variety of wide spread financial and non-financial services to 71.5 million retail and commercial customers. The Group's headquarter is in Spain, where the Group has concrete leadership in retail and commercial markets. BBVA adopting innovative, and customer and community oriented management style, besides banking, operates in insurance sector in Europe and portfolio management, private banking and investment banking in global markets.

BBVA which is the largest financial institution in Mexico and also a market leader in South America, operates in more than 25 countries with more than 121 thousand employees.

See the BBVA group shareholder reports here.

ABOUT INSIDER HOLDINGS

The chairman, members of the Board of Directors, the CEO, and the Executive Vice Presidents are allowed to own publicly traded shares of Garanti BBVA in accordance with the limitations set out in Capital Markets Board regulations and the internal regulations of the Bank. Their transactions in Garanti BBVA shares are publicly disclosed pursuant to Capital Markets Board regulations. Pursuant to Article 11/2 of the Communiqué on Material Events Disclosure numbered II-15.1, if and when the total amount of transactions made on behalf of persons with administrative responsibility exceeds TRY 8,000,000 (*Revalued figure/value for 1.1.2024 – 31.12.2024, pursuant to the announcement made following the Decision of the Capital Markets Board dated 28.12.2023 and numbered 81/1811) within a calendar year, it is publicly disclosed.

There is no ultimate non-corporate controlling shareholder holding more than a 5% share in the shareholding structure.

You can access the special situation statement dated 29.08.2023 regarding the share purchase and sale transactions carried out within the scope of the Capital Markets Board's Special Circumstances Communiqué numbered II-15.1 from here.